Over 6 percent of insured homes will have a claim this year, and every new sunrise brings another 16,000 reported auto accidents.

Modern life is risky business, but with the right personal insurance options, you can protect your family against a myriad of risks.

Insurance of any type is the transfer of risk from an individual to a group. If you lost your house in a fire or your car in an accident, the expense of rebuilding your home or replacing your car can be a financial disaster.

Without insurance, all the risk for a potential loss falls to you. An insurance company acts as a facilitator, collecting premiums from all its policyholders according to their unique risk profiles and then paying claims when there is a covered financial loss.

Your insurance policy is a contract, and like any contract, it’s important to understand the details and how those details affect the coverage you pay for when you buy insurance. It’s entirely possible — and even common — to have insurance but not be covered for risks you might expect to be covered.

This guide is designed to help you understand the basic principles of personal insurance. We’ll explore common coverage considerations and frequently found gaps in coverage. Armed with a better understanding of your insurance needs allows you to make well-informed buying decisions to protect your family and finances.

What Is Personal Insurance?

Personal insurance includes the types of insurance that aren’t business-related, such as personal auto insurance, home insurance, life insurance, personal liability insurance, and health insurance.

By contrast, business insurance, while based on the same principles as personal insurance, is designed for the specific needs of businesses. The two types of insurance typically do not cover losses from the other, i.e., personal insurance does not cover business-related losses and vice versa, although there are some areas in which a home policy can provide limited protection for business risks.

In some cases, insurance is required by state law. For example, 49 of the 50 states require drivers to carry auto insurance. For curious readers, New Hampshire instead requires drivers to meet financial responsibility requirements.

You may also need to purchase insurance to meet the requirements of another contract. Auto loans or mortgages are both examples of contracts that typically require buyers to purchase personal insurance policies to protect the purchased asset.

The car or home act as the lender’s collateral, their way to collect on the loan balance if it isn’t paid, and they want you to protect your car or home. It may seem funny to think of it this way, but a lender tends to view your house or car as their house or car, at least until the loan is paid off.

This relationship also touches on the idea of insurable interest, which we’ll cover later in the guide. Your lender has financial exposure through the loan balance and therefore has an insurable interest in the car or home. This means the lender can purchase a policy on your behalf if you don’t have insurance. It’s almost always better to purchase your own coverage.

It’s also important to note that an insurance policy isn’t a maintenance contract, nor does it cover intentional acts. The words “sudden and accidental,” or equivalent language, appear frequently in insurance documents as a subtle reminder that claims due to maintenance items or neglect won’t be covered. But if an insured item becomes damaged, and the cause of damage is both sudden and accidental, your insurance policy just might save the day.

A Brief History of Personal Insurance in the U.S.

The roots of insurance go back as far as the Roman Empire, when soldiers collected money to give to the widows and families of their fallen brothers in arms. Today, we have a thriving life insurance business that borrows the same well-intentioned sentiment from ancient history, using an insurance policy to provide for a family after a key income earner has passed.

There is also evidence of pooled risk among merchants in ancient Sumer and Babylonia dating back as far as 3,000 BC. These arrangements, providing protection against piracy, represent some of the earliest roots of what would later become business insurance.

Modern insurance, and all its incarnations, can thank Ben Franklin for helping to make insurance a part of the national fabric. In 1752, he founded the Philadelphia Contributionship for the Insurance of Houses from Loss by Fire. Long before cars became part of our lives, insurance policies focused largely on life and homes. And the earliest home policies were extremely limited, often only covering damage from fire.

Philadelphia Contributionship, while not as well known as some national insurers, is still insuring homes and is respected among its peers for its abundance of coverage options for home insurance needs.

Today, the U.S. insurance industry takes in over $1.3 trillion annually in net premiums and employs more than two and a half million workers among its nearly 6,000 insurers.

How Does Personal Insurance Really Work?

Insurance is governed at the state level and is subject to state laws, which differ from state to state in some cases and can change from year to year. This guide focuses on insurance concepts that apply nearly universally throughout the U.S.

Insurance is the transfer of risk from an individual to a group. However, each insured person pays into a pool from which the insurer can pay claims. The payments collected from policyholders for coverage are called premiums.

Insurers attempt to rate your risk and weigh the coverage amount (which is also the potential claim amount) to determine a premium to charge. So, premiums vary from one household to the next because we each bring different levels of risks to the pool, and we each choose our coverage limits.

Risk, for you, means that you might lose the value of something you own or which has financial value to you. Risk, for the insurer, means they might have to pay a claim if you have a loss. Insurers determine your risk in a number of ways — sometimes using thousands of data points — some of which we’ll discuss as well.

When the insurer collects premiums, they invest some of those premiums while some are kept in a reserve account that they use to pay claims.

Each state also has an insurance commissioner, and the insurance commissioner is responsible for enforcing insurance regulations — but also, in many cases, for approving or denying rate increases.

Generally speaking, an insurance company can’t raise rates across the board without going to the state first and showing why they need the rate increase. Individually, we can still see large changes in our rates, but this is often because something has changed to indicate we may pose a greater or lesser risk of a loss.

Insurance companies are either “stock companies,” which have owners or investors, or they are “mutual companies,” which are owned by the policyholders.

Having a policy with a mutual company makes you an owner, but it doesn’t mean you can fire the CEO because your claim didn’t go as smoothly as hoped or your rates went up. In many cases, though, a mutual company will pay a dividend on policies if there is excess after paying claims and expenses and funding reserves. Sometimes these dividends are reserved for select types of policies, and dividends aren’t guaranteed. But dividends deliver a nice surprise in an industry where surprises usually aren’t a good thing.

By contrast, with stock companies, you do not own part of the insurer. However, many are publicly traded, allowing you to purchase shares if you feel insurance might be a good investment area. The strategy performed well for Warren Buffett.

Your insurance policy spells out the coverage you’ve chosen as well as any exclusions to coverage. Again, the policy is a contract that details the responsibilities of each party. If you have a covered claim, the insurer will pay the claim, subject to your coverage limits and minus your deductible. In some cases, other factors, such as coinsurance (discussed later), can also affect the amount paid in the claim.

Insurance rates are assigned individually, based on your unique rating factors. Insurers look at hundreds or even thousands of data points to determine your premium. Individual premiums reflect the insured value defined in the policy and the risk of a claim as indicated by the data points just mentioned.

Statistically speaking, insurance applicants who fit certain criteria can be riskier or less risky, with a higher statistical risk of a payable claim often leading to higher premiums. For example, younger drivers tend to have more accidents and costlier accidents compared to more experienced drivers. As a result, insurance rates for younger drivers tend to be higher.

Believe it or not, your credit score may also play a large factor in insurance rates as well. People with higher credit ratings can usually expect lower rates than someone with a less-than-perfect credit score, assuming all other rating factors are equal. However, some states restrict insurers’ ability to use credit history as a rating factor.

Key Insurance Definitions

Like most industries, insurance has a vocabulary of its own. Here are some key terms to know.

- Premium: The premium is the annual or semi-annual amount you pay for your insurance. For most types of policies, policies and premiums are based on a full year. In the case of auto insurance, many insurers have moved to 6-month policies, which allows insurance companies to be more nimble in regard to adjusting rates and, if appropriate, non-renewing policyholders. Most insurers allow policyholders to split their premium into monthly payments.

- Deductible: The deductible is the part of the insurance claim paid by the insured. Deductibles can be a flat amount, such as $500 or $1000. Alternatively, deductibles can be a percentage of a coverage amount. For example, a home policy might use a two percent deductible for certain claim types. Home and auto insurance both use separate deductibles for different types of coverage in the policy. For instance, your auto collision coverage and your auto comprehensive coverage both have their own deductible.

- Coinsurance: The term coinsurance may be familiar to you from its common use in health insurance. In other types of personal insurance, coinsurance can be a concern if the rebuild or replacement cost differs dramatically from the insured value. A home insured for less than 80 percent of its rebuild cost can be subject to coinsurance, meaning you pay a percentage of the claim. For example, in a covered claim for a home insured to 50 percent of its rebuild cost, you would pay 50 percent of the claim, as well as the deductible.

- Actual Cash Value: In the insurance world, there are two primary ways that you can be compensated for a loss. The first of these, commonly used with auto insurance and with personal property coverage on home insurance policies, is called Actual Cash Value (ACV), which pays based on a depreciated value for insured property.

- Replacement Cost Value: The other primary way of covering personal property is called Replacement Cost Value (RCV), which pays the true cost of repair or replacement for insured items in a covered claim. A standard home insurance policy provides replacement cost coverage for the home itself, although most policies offer actual cash value coverage for the home’s contents.

- Exclusion: An exclusion describes a specific risk not covered by your insurance policy. Some real-world examples include floods or land movement on a home insurance policy or damage caused by drag racing on an auto insurance policy. Neglect and intentional damage by the insured are also commonly listed as exclusions.

Personal Insurance: Auto Insurance

Auto insurance is required in 49 of the 50 states. New Hampshire is the exception, which instead has a law that requires that you have enough money to cover a minimum level of liability if you do not have auto insurance.

Because insurance is governed at the state level, minimum required coverage amounts and coverage options vary for each state. But most of the coverages themselves are substantially similar. The most meaningful difference is found in how each state’s policy handles medical coverage if you are injured by an automobile.

Auto Liability Coverage

Liability simply means that you are responsible for damages to others, including either bodily injury or property damage. Typically, an auto insurance policy has separate limits for each type of liability, a structure called split-limit coverage, although some use a combined coverage limit.

Your policy coverage might look something like this:

$100,000 / $300,000 / $50,000

In this example of split-limit coverage, you have $100,000 in bodily injury liability coverage per person, $300,000 in bodily injury coverage per accident, and $50,000 in property damage liability coverage.

Bodily injury is the area where drivers have the most potential exposure because you can be found liable for not only medical expenses but also pain and suffering and lost wages. The expenses can add up quickly.

If your liability exceeds the coverage amount you’ve purchased with your policy, you are responsible to pay the balance even if you don’t have enough money to cover the liability. This situation can lead to forced liquidations, judgments, and garnished wages in some cases, so it’s important to choose a coverage amount that’s adequate for most claims.

The coverage amounts in the example above are a starting point recommended by many agents.

Auto property damage liability refers to the responsibility to compensate others for accidental damage to their property. In most cases, this refers to damage to other cars, but it can be any type of property owned by others that we sometimes bump into with our cars. Think street signs, guardrails, houses, store windows, etc.

Pro Tip: The difference in cost for increasing auto property damage liability coverage from $50,000 to $100,000 is usually negligible on a monthly basis and brings added peace of mind.

Your policy may also have coverage for Uninsured Motorists (UM) and Underinsured Motorists (UIM). This provision is to protect you if you are injured or your vehicle is damaged by an uninsured driver or a driver without enough coverage to pay for their liability to you.

While UM and UIM aren’t liability insurance in the strictest definition, they provide a way for your own auto policy to protect against uninsured liability due to the actions of others.

Auto Collision Coverage

When we think of auto insurance, most of us think of collision coverage. But collision coverage is just one part of the policy. And it’s not required by law.

Auto collision coverage pays to repair damage to your car if your vehicle is damaged due to an impact with another car or a stationary object.

This coverage is optional because damage to your car doesn’t create a liability to anyone else. Basically, it’s your loss.

However, most auto loans will require collision coverage as part of the loan contract because the loan is secured by the car. In the event of non-payment, the lender would prefer to repossess an undamaged car or to be paid by the insurer if the car is a total loss.

Any covered claims are subject to your chosen deductible, which will be subtracted from your claim payment.

Once the cost estimates of repairing a vehicle damaged in a covered claim approach 70 percent of the vehicle’s value, the odds increase that the insurer will deem the vehicle a total loss. The small difference between the estimate and the vehicle’s value is often consumed with additional repairs that aren’t discovered until the repair has begun.

When involved in an accident that is not your fault, you have the option to pursue the claim through your insurer or through the other driver’s insurance company.

Using the other driver’s insurance company saves you the cost of your deductible but the other company may not be as efficient at handling the claim as you might hope. If you use your own insurance company, a process called subrogation, you will have to pay the deductible you’ve chosen for your collision coverage. If your insurer can collect the deductible from the other driver’s insurance company, your insurer will return your deductible as well.

Accidents that are your fault can impact your rates both with your current insurer and with a new insurer. Accidents that are not your fault may appear in underwriting reports but do not count against you in regard to your rates. The good news is that driving mishaps don’t affect rates forever. In most cases, accidents only affect rates for three to five years.

Auto Comprehensive Coverage

If collision coverage is for collisions, then you can think of comprehensive coverage as being for everything else.

Well, almost everything else.

Auto comprehensive coverage pays toward the repair for damage from fire, theft, vandalism, broken glass, floods, falling branches, and similar occurrences that do not involve impact with another vehicle or a stationary object.

Comprehensive coverage is optional but may be required by your lender.

According to the National Association of Insurance Commissioners (NAIC), comp coverage averages less than $172 per year, whereas the nationwide average for collision coverage tops $380 annually.

Claims covered under comprehensive coverage won’t usually affect your rates the way a collision claim might. However, insurers have been known to require a higher deductible for customers with frequent comprehensive claims and may non-renew your policy if you place numerous claims of any type.

Collision and comp coverage together are also called physical damage coverage because both coverage types focus exclusively on claims that involve damage to your vehicle. On a standard auto insurance policy, both coverage types also use “actual cash value” to calculate the insured value, as described next.

Actual Cash Value for Auto Insurance

With the notable exception of specialty policies for antique or collector cars, which usually use an “agreed value,” nearly all auto policies cover your car for actual cash value (ACV).

Actual cash value is a depreciated value based on wear and tear due to age. It does not track your loan balance or the amount you’ll need to buy a new car. Instead, actual cash value seeks to track your actual loss, capping the coverage limit at the vehicle’s current value.

This means that your insurance policy might not pay enough to replace your vehicle with the same year, make, and model. However, the majority of accidents don’t result in a total loss, so this structure isn’t a problem in most claims.

Newer cars may be the most vulnerable to this type of coverage gap because new cars often experience faster depreciation. Some insurers provide extended coverage to help bridge the gap between the car’s insured value and the remaining loan balance.

A Few Words on Personal Insurance Deductibles

Some personal insurance policies are quoted and then bound with a high deductible to make the premium more attractive. This seems great — until you have a claim.

When you have a claim, the deductible becomes more than just numbers on an insurance document. The deductible is subtracted from your claim payment. This means the deductible can take a big chunk out of your claim settlement or prevent your claim from being paid at all. Your financial exposure from deductibles can be hundreds or even thousands of dollars. And many times, customers don’t understand how their policy is structured until there is a claim.

Ask your agent to explain how much your deductible will be if you have a claim. It’s much better to know before the claim happens so you can make changes to your policy or put some money aside, just in case.

Auto Insurance Med Pay or Personal Injury Protection

Most of the state laws regarding auto insurance are fairly similar in how they manage coverage for the car itself. Where these laws begin to diverge is with coverage for drivers covered by the policy who are injured by an automobile.

The two commonly-used coverage solutions are called Med Pay and Personal Injury Protection. Which one of these options are available in your state depends on the state you live in — and some states have both. The main distinction is that Personal Injury Protection includes provisions to pay toward lost wages, or even a life insurance provision, and is generally structured to be a more comprehensive solution than Med Pay.

This area of personal insurance coverage can be tricky business because health insurance companies may not pay for your medical care until the provisions of your auto insurance policy are exhausted. It’s recommended that you carefully review your coverage with your agent and ask for examples of how your medical expenses would be paid — including how much you would be responsible to pay.

There are policies in force now that leave the consumer responsible for the first $2,500 of medical expense, with copayments taking another chunk out of the claim payment. While these policies have lower premiums than the same policy with a lower out-of-pocket cost, the out-of-pocket costs can be substantial and can occur at a time when you might least be able to afford the expense.

Depending on your state — and your health insurance provider, you may also have the option to make your health insurance the primary provider for your health care if you are injured by an automobile. When available, choosing this option can lower your auto insurance premium — but if your health insurance provider does not support the option, you may be subject to substantial additional costs if you have a medical care claim. When choosing health insurance as a primary provider on an auto policy, be sure to verify that your health insurance provider supports the coverage selection.

Note the importance of the phrase “injured by an automobile” as opposed to “injured in a car accident.” It’s important to understand that even if you pinch your pinky with the car door or bump your head getting out of a car, your medical coverage may be governed by the coverage on your auto insurance policy, although specific rules vary by state.

Personal Insurance: Home Insurance

A home is indeed a castle in that a home is regarded as a safe place, but a home faces risks both to its structure and to the contents inside. This year, one in 15 insured homes will have a claim. Home insurance comes in many types, some of which are simply specific to the type of home or specific to the type of occupancy, meaning whether the home is owner-occupied or rented to tenants. In addition to providing coverage for the dwelling (the house) and personal property (your belongings), most home insurance policies also include a limited amount of personal liability coverage, helping to keep you safe from lawsuits as well.

Named Peril Policy vs. Open Peril Policy

Home insurance policies come in several common types, but one of the primary considerations is the type of risks, referred to as “perils” by insurers, that are covered by the policy. A named peril policy covers your home for only the perils named in the policy — and also specifically excludes certain perils, called exclusions. An open peril policy covers your home for all perils, with the exception of those perils that are specifically excluded.

It’s common for a home insurance policy to have mixed coverage, meaning the house itself is covered as open peril while the contents, your belongings, are covered only for named perils.

Named peril policies are becoming less common for homeowners insurance policies, but they do still exist — and many have been in force for years. Other types of home insurance, like renters insurance which doesn’t cover the dwelling, are typically named peril policies.

Homeowners Insurance

A homeowners insurance policy is the type commonly purchased for a single family home or townhomes, although some more limited policy types are also available. Most insurers sell an HO-3 policy which provides open peril coverage for the dwelling and named peril coverage for personal property. Some insurers offer an HO-5 policy, which is open peril for both the dwelling and your personal property. These open peril policies often also offer replacement cost coverage for your personal belongings as opposed the actual cash value coverage offered by other policies.

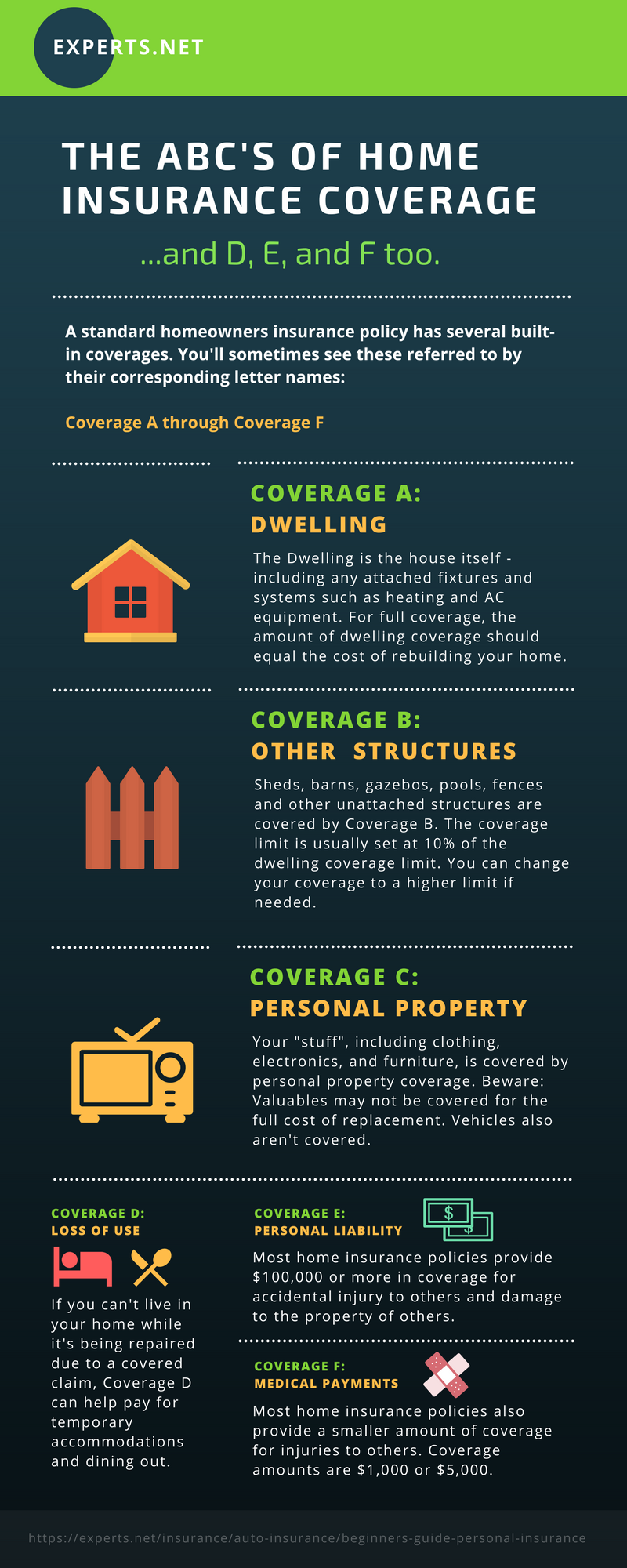

- Dwelling Coverage: The dwelling is your house itself, including its systems and attached fixtures. Dwelling coverage is typically replacement cost coverage — with the notable exception of your roof. Due to common — and expensive — roof claims caused by wind and hail damage, many insurers have moved to actual cash value or a depreciation schedule for roofs. Dwelling coverage is often based on the actual cost of rebuilding your home as opposed to market value and should be reviewed with your agent or insurer to be sure your home is fully insured.

- Other Structures: Sheds, fences, gazebos, pools, and other unattached structures on your property are covered by “Coverage for Other Structures”, which is included with most homeowners insurance policies.

- Personal Property Coverage: Your belongings are covered by personal property coverage, but most policies cover your personal property for actual cash value. This means that in a covered claim you may be paid less than it costs to replace the item(s) damaged in the claim. Valuables are also commonly limited both by type and per item. For example, jewelry may be limited to $2,500 of coverage in a claim with a single item limit of $1,000. Actual limits vary by insurer and other categories of valuables, such as musical instruments and firearms, are also often limited. Personal property coverage can cover your belongings anywhere in the world, but deductibles can prevent claims for single-item losses if the value of the lost or damaged item is less than the deductible.

- Loss of Use: If your home is temporarily uninhabitable due to a covered claim, a standard homeowners insurance policy will pay toward your costs for hotels or eating out while your home is being repaired. This coverage isn’t unlimited and base coverage amounts may be less than you need if your home needs extensive repairs. You often have the option to raise your coverage limits to a higher amount.

- Personal Liability Coverage: If you are found liable for injury to others, a standard homeowners insurance policy can pay toward the judgement amount, subject to your coverage limits. The good news is that the cost of your legal defense, often included, is usually outside of your coverage limits, which means the cost of your legal defense won’t reduce the amount of personal liability coverage available. Liability incurred as a result of business-related activity, including home-based businesses, typically isn’t covered. Common coverage amounts are $100,000 and $300,000, but the difference in cost between the two is often only about $20 per year.

- Medical Payments to Others: Smaller injuries for non-family members and that don’t involve lawsuits can be covered by medical payments coverage. Options are $1,000 or $5,000, with the difference in cost between the two options usually being less than $10 per year.

Endorsements to Consider: Many insurers offer options to fill some of the gaps in coverage. Below are some of the more common endorsements. You can think of an endorsement as something that changes your policy — in these cases, adding new coverages.

- Backup Sewer and Drain / Sump Pump Overflow: As its name suggests, this optional add-on provides coverage for sewer backups and sump pump overflows, neither of which are covered on a standard homeowners insurance policy.

- Scheduled Personal Property: Limits to coverage on valuables can be overcome by adding your valuables to your policy as scheduled items. This insures your scheduled items to their full value. Your insurer will require an appraisal or a recent receipt to verify the value of scheduled personal property. If your policy does not provide an option to schedule personal property, you can purchase a personal articles policy, a policy that allows you to manage your valuables separate from your homeowners insurance policy.

- Land movement: Some insurers provide an option to add coverage for land movement or earthquakes. These perils aren’t covered by a standard homeowners insurance policy. Expect a separate deductible for this coverage, usually structured as a percentage of the dwelling coverage amount.

- Replacement Cost Coverage for Personal Property: Most homeowners insurance policies cover personal property for actual cash value, a depreciated value based on wear and tear due to age. Some insurers provide an option to cover personal property for its full replacement cost, filling a potentially costly gap in coverage.

Renters Insurance

A renters insurance policy is a simpler policy than a homeowners insurance policy but has many similarities. Notably, dwelling coverage and coverage for other structures are not in the policy because the dwelling is owned by the landlord, but the other provisions — and limitations — of a homeowners policy also apply to a renters insurance policy. A renters insurance policy covers Personal Property, Loss of Use, Personal Liability, and Medical Payments to Others.

Condo Insurance

You can think of a condo insurance policy as a scaled-down homeowners insurance policy. A condo owner owns the inside of the condo, while the condo association usually owns the building. This limits the dwelling coverage substantially, effectively making it insurance from the studs inward, including carpets, fixtures, etc. The rest of the policy and options for condo policies closely parallels a homeowners insurance policy, providing coverage for Personal Property, Loss of Use, Personal Liability, and Medical Payments to Others.

Landlord Insurance

If you own a home you have rented to others, you’ll need a special kind of policy called a landlord policy or a rental dwelling policy. If your rented home or residential building has more than 4 units, you’ll need a commercial landlord policy. Coverage for landlord policies is usually limited to the dwelling and other structures, with a smaller coverage amount for personal property. Liability coverage is often included with higher optional limits than commonly found with a standard home insurance policy. Because a rented home is not owner-occupied, the risk may be higher, and premiums are typically up to 25 percent higher than a standard homeowners insurance policy for the same home.

Flood Insurance

Home insurance policies cover household water mishaps such as spills and overflows, but if the water touched the ground before entering your home, that’s a flood — and it’s not covered by your home insurance policy. Most agents can quote and bind a separate flood insurance policy, which provides coverage for damage to your home or its contents due to floods. Personal property stored below ground level won’t be covered, and vehicles also aren’t covered by a flood insurance policy. According to FEMA statistics, about 25 percent of flood claims are for homes that aren’t in a floodplain.

Deductibles for flood policies tend to be higher than a standard home insurance policy, and rates are determined by insured value and the property’s assigned flood zone, which takes into account elevation, proximity to water, and historic flooding events. The average cost of a flood policy is just under $700 per year, but premiums can range from a few hundred dollars up into the thousands. Coverage for claims is limited to $250,000. However, the average claim for flood damage to a home is about $40,000.

Earthquake Insurance

Land movement, including sinkholes, settling, mudslides, and earthquakes, is a named exclusion on most home insurance policies.

Some insurers offer an endorsement that adds coverage for earthquakes or other types of land movement, but in most cases, you’ll need to purchase a separate policy if you want coverage for these perils.

Earthquake insurance deductibles are usually a percentage of the dwelling coverage amount, which can add up quickly and often prevents any smaller claims. If you choose to purchase coverage for earthquakes and land movement, consider its primary value to be in a case of extensive damage or a total loss.

Hurricanes and Named Storms

If your home is damaged by a named storm, meaning a hurricane or tropical storm that has been given a name, your coverage may be subject to a special deductible which is usually structured as a percentage of the dwelling coverage. In the insurance business, this deductible is commonly called a hurricane deductible, and it supersedes your standard deductible if your home is damaged by a hurricane or a named storm. For example, a home insured for $300,000 with a 3 percent hurricane deductible leaves the insured homeowner responsible to pay for the first $9,000 in repairs in a covered claim — but only if the damage was caused by a named storm.

Hurricane deductibles have become more common following several damaging hurricanes, and because hurricanes can cause such widespread damage, some insurers won’t write coverage for homes near the coast. While Hurricane Katrina is the most infamous for its damage, other recent storms give it some competition in regard to devastation. Hurricanes Harvey, Irma, and Katrina all caused between $150 billion and $200 billion in damage each.

Personal Insurance: Mobile Homes

Mobile home insurance is similar to home insurance for a stick-built home — with one large exception. The dwelling coverage for a mobile home is often based on actual cash value. This means that, unlike a traditional single-family home, which tends to appreciate in value, a mobile home depreciates, much like a car. This can create a massive gap in coverage if your mobile home suffers significant damage due to a covered peril, leaving you without enough money from your claim payout to rebuild or repair your home. Even small claims can be hit by depreciation, causing smaller claims to not be payable after your deductible is subtracted.

However, there are some personal insurance providers that offer replacement cost coverage for mobile homes, although replacement cost coverage may be limited to newer homes. Be sure to ask if the coverage is for replacement cost and to ask the difference in cost between the two options if both exist so you can make a more educated buying decision.

The balance of the policy and options for a mobile home policy closely parallels a standard homeowners insurance policy, providing coverage for Personal Property, Loss of Use, Personal Liability, and Medical Payments to Others.

Vacant Homes

A vacant home is attractive to thieves and vandals, and while the home is empty, risks like leaks, burst pipes, insects, rodents, or fires can destroy a home. For these reasons, many insurers won’t insure a vacant home or will only provide coverage for a short grace period. A home insured with a standard home insurance policy that is vacant for over 60 days may lose coverage for risks such as vandalism and other perils. Additionally, the insurer may cancel the policy because coverage was issued with the understanding that the home would be occupied.

Special policies are available for vacant homes, but some can be a pricey experience for homeowners. Be sure to compare several quotes before buying coverage.

Personal Insurance: Liability Insurance

Personal liability is a part of an auto insurance policy, but only for auto liability, and often included with home insurance policies, but not covering any auto liability risks. Liability can occur in a number of ways and isn’t limited to bodily injury liability or property damage liability, although these are the most common. Personal liability can include libel or slander, both of which are forms of defamation. Your home insurance policy may afford you some protection in defamation lawsuits, but many don’t — or require a personal injury endorsement.

An umbrella policy is another option that often provides expanded coverage for most types of personal liability and sits over your home and auto insurance policies to provide protection when the liability coverage limits of those policies are exceeded. Liability coverage from some other policies, such as RVs, is also extended. Coverage options usually begin at $1 million, and an umbrella policy requires that the underlying policies have the following minimum coverage limits:

- Auto Insurance: $250,000 / $500,000

- Home Insurance: $300,000

- RV Insurance $250,000 / $500,000

Historically, umbrella policies have also been called “pool policies” because they help to cover the higher insurance needs that go hand in hand with the risks of owning a swimming pool.

Personal Insurance: Life Insurance

While life insurance has evolved into an industry that offers both simple and complex policies, a simpler policy is usually the best fit for most families. Options include term life insurance and a number of types of permanent life insurance.

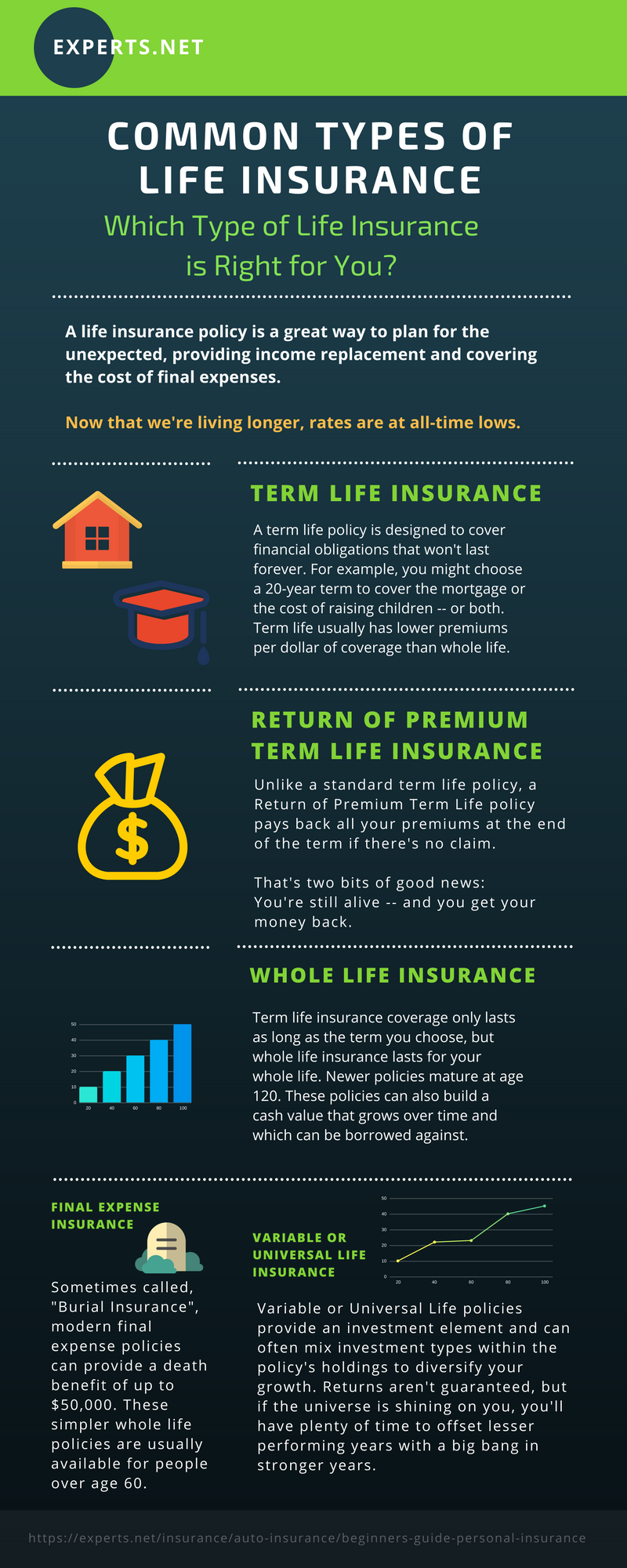

Term life insurance has lower premiums because the policy only provides coverage at a fixed premium cost for a limited amount of time. This structure makes term life insurance less expensive — but also makes it well suited to covering expenses that don’t last forever. A mortgage is usually 30 years and the costs associated with raising a child usually last about 20 years. If your goal is simply to cover these expenses if you pass unexpectedly, term life insurance deserves a closer look.

In its simplest form, you can think of life insurance as income replacement, and with that in mind, you may choose a death benefit coverage amount that not only covers your known financial obligations but also provides some income for your family.

- Term life insurance policies can be purchased for terms ranging from 5 years up to 40 years, but your options — both in coverage amounts and term lengths — may be limited as you get older. The risk with term life insurance is that if you pay premiums for the entire term and don’t die, the money you spent on premiums is gone. The good news is that you’re still alive, and there’s also an option to purchase a special policy called Return of Premium Term Life Insurance.

- A Return of Premium policy gives you back all your premiums at the end of the term — assuming you’re alive. If you died early or unexpectedly, your beneficiary will be paid for the life insurance claim. Return of Premium policies cost more than a traditional term life policy but may be worth the added expense because the coverage is effectively free if there isn’t a claim.

- Permanent life insurance is designed to provide coverage for your entire lifetime and includes whole life insurance as well as variable life insurance, which can build cash value through investments and can provide some flexibility in premiums. If your interest in life insurance includes its tax-advantaged investment options or as a detailed part of estate planning, discuss your life insurance needs with an experienced agent who can help you understand some of the more complex options often found in various forms of permanent life insurance.

Personal Insurance: Boats, Personal Watercraft, or ATVs

Boats and ATVs can be lots of fun or provide utility, but they also come with risks. Specialty boats, like yachts or sailboats, require a specialized policy, but smaller boats and ATVs are often insurable through your local agent. In some cases, you can even add liability coverage for these vehicles to your home insurance policy. However, most insurers offer only limited coverage, instead providing more comprehensive coverage through a separate dedicated policy.

Personal Articles Insurance

As mentioned in the Homeowners Insurance section of this guide, your valuables often have only limited coverage — unless they are added to your policy as scheduled items with an appraisal or a recent receipt. However, some insurers don’t provide this option. Your alternative is to purchase a personal articles policy to insure your valuables to their full value. This type of policy may be intriguing because it can cover nearly anything you want to insure for full value. We often think of jewelry when we think of valuables, but a personal articles policy can even be used for items such as drones or other items you’d like to specifically insure. Often, claims for losses on a personal articles policy have no deductible or lower deductible options than the personal property coverage on a standard home insurance policy.

Insurable Interest for Personal Insurance Policies

It’s often said that insurance is tied to ownership, and that’s sometimes true — but not always. Both business and personal insurance require insurable interest, which means you need to be able to show you’d be financially harmed by a loss. Life insurance is an example of where insurance does not require ownership, only an insurable interest in the life value (usually income) of the insured.

You can’t insure your neighbor’s home or car because if there were a loss, it wouldn’t affect you financially. Without the insurable interest requirement, insurance would be a hotbed of vandalism, arson, malicious mischief, and worse — because of the profit motive. Not everyone is as honest as you are.

Where insurable interest becomes very important to understand in some households is in the case of vehicles and young drivers. It’s often less expensive to add a young driver to a family policy than for that young driver to purchase their own policy. However, if your teen’s first car is titled and registered to your teen, you can’t add that vehicle to the family policy, which is reserved for the named insured and spouse. Keeping the car in your name can keep premiums lower but can also expose you to liability and claims from the young driver. This is a decision each family makes and one that deserves careful consideration.

Why Do Personal Insurance Premiums Go Up or Down?

Insurance rates are a reflection of individual risk and insured value, the latter of which refers to the coverage amount. If the risk or insured value is high, it’s a safe bet that rates will be higher as well — and vice versa. Rates can go down as you earn discounts for being claims-free for a certain amount of time or if an old accident or claim finally falls off your history. Some insurers also offer loyalty discounts which are triggered by staying with an insurer for a prescribed amount of time. Reaching age milestones usually make insurance rates go down as well, until about age 70 when some insurers begin to raise rates.

Personal insurance rates can increase due to reasons associated with your risk — or because of external factors, such as a surge in claims. For example, low gas prices combined with nice weather often lead to more driving. Laws of averages tell us that more driving leads to more accidents — and more claims. The margin between premiums collected and claims paid is often thin, and a spike in claims can put a big dent in an insurer’s reserves. When this happens, your rates may go up — and not for anything you did — except drive a bit more, like everyone else.

Changes in credit can affect your insurance rates more than you might expect, and, of course, claims can change your rates. Insurers already suspected you were risky, and now you’ve proven it by having an accident.

Be sure you understand your new policy if switching insurers because your rate has gone up. What sometimes happens is that a customer switches companies, wooed by “new customer” discounts, only to have the discounts disappear when the customer is no longer “new” and then watch as that company raises rates as well.

Captive Agent vs. Independent Agent

A captive agent usually works exclusively with one insurer, although some may have limited relationships with outside vendors when permitted by the primary insurer. The advantage of a captive agent is that they work with one insurer and one set of policies, so it’s a good bet they know the insurer’s offering pretty well — as well as its pitfalls, although the latter may or may not be discussed. By focusing on the products from one insurer, it’s also easier to train staff, making the entire office better educated and well-versed on your options and coverage details.

An independent agent isn’t tied to a specific insurance company but instead has agreements with several insurers. If a policy or the underwriting requirements from one company aren’t a good fit for the customer, the agent likely has others policies they can quote and present. Often, an independent agent can also service more types of specialty insurance, including specialized business policies that a captive agent may not have available — simply because their insurer doesn’t offer that type of policy. This won’t be a concern for most households but could be a consideration if your insurance needs go beyond the basics.

When shopping for personal insurance, it’s a good idea to meet with an agent (or two) to discuss your needs and concerns. Maybe you’ll buy your policies from that agent, or maybe you’ll buy your coverage elsewhere, but either way, you’ll learn more about your coverage and possibly discover some gaps or exposures you hadn’t realized existed. The process also allows you to compare quotes from different personal insurance companies.

The Importance of an Annual Insurance Review

Okay, maybe you can stretch it to 18 months or 2 years instead of every year — but it’s important to review your insurance coverage regularly because life changes on us quickly — and so do our insurance needs. A missed gap in coverage can be a costly learning experience. It’s common during insurance reviews to find several aspects of your insurance coverage that aren’t as well-suited to your current situation as they once were. Insurers also introduce new discount programs to remain competitive, so it’s possible you’ll learn of some new ways to save on your premium.

Ask about multi-policy discounts when shopping or during your insurance review. The discount for buying more than one type of personal insurance from an insurer, also known as “bundling,” can be among the biggest discounts available to you. It isn’t unusual to see discounts of up to 35 percent on a home policy if you also have auto insurance with that insurer. Discounts on auto policies can be up to 10 percent if you also have home insurance with the same insurer. Depending on the cost of your policies, the combined savings can be several hundred dollars per year.